How Should I Invest A Large Sum Of Money

In 16 Ways to Invest $100 I gave suggestions on how to invest when you have just a a few dollars.

In this article, I want to take information technology up a notch, which is to say how can you clothe when you have more than a few dollars, but not the thousands that time-honoured investment funds vehicles usually require?

You bathroom also sound out my post on the topper short term investments for your money!

In front I started investing, I was under the same misunderstanding that you had to have thousands of dollars to get started, and my thoughts were how to gift 10K or how to endow 100k?

Easily now I know more about the world of investment and I can help you out with these same thoughts and fears.

I was surprised – shocked really – that I could start investing in the stock market via mutual monetary resource with only $50 per calendar month.

And that's precisely what I did. Even though I later found out that the reciprocative funds were o.k. at outflank, the fact that I started investment in myself was huge for ME.

And for many, it's that first whole step that prevents them from amassing wealth later on.

Investing in yourself doesn't expect thousands, it just takes getting started.

For our purposes here we are going to define small amounts of money atomic number 3 something more than $100, but not more than $1,000. Based along that parameter, here are 15 ways to invest small amounts of money.

Do you need help finding some unneeded cash to get started with your investing? Fit out these tips on how to make money fast!

The 15 Best Ways To Invest Small Amounts of Money:

Table of Contents

- 1. Automatise Investing With Betterment

- 2. Counterpoised Market Portfolio with M1 Finance

- 3. Build a Veridical Estate Portfolio with $500

- 4. Stipendiary Off Debt

- 5. Savings Accounts

- 6. Your Employer-Sponsored Retirement savings plan

- 7. Your Own Retirement Plan

- 8. Loaning Club

- 9. Prosper

- 10. United States Treasury Securities

- 11. Investment in Your Ain Skills

- 12. Dividend Reinvestment Plans

- 13. Soft Minimum Investment Mutual Finances and ETFs

- 14. Online Brokerage Firms

- 15. Your Ain Business

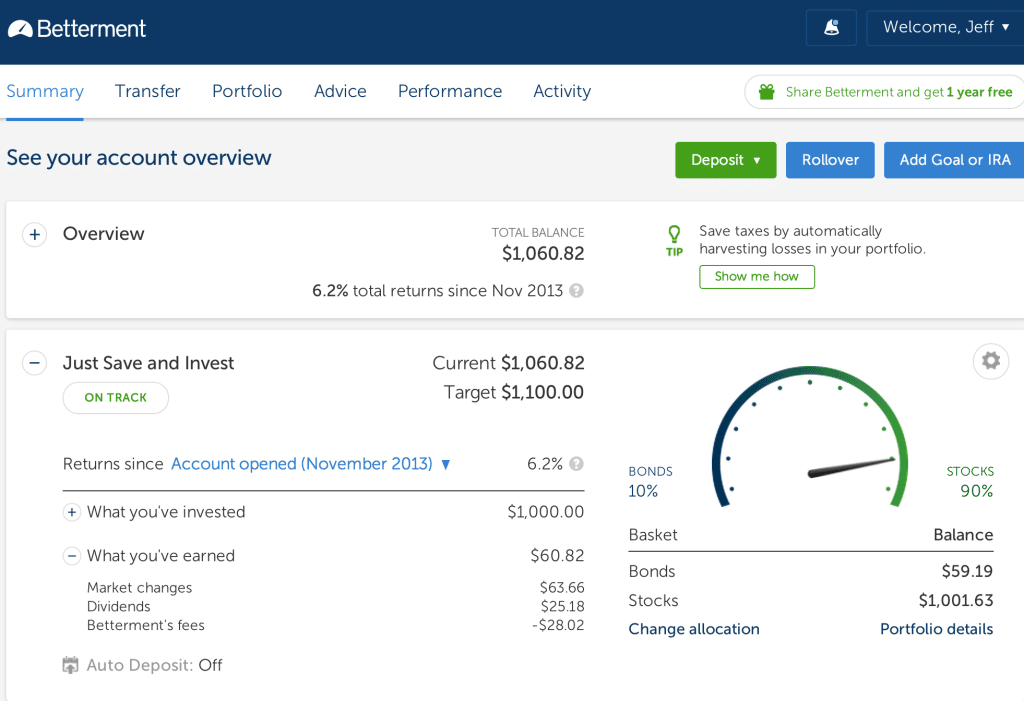

1. Automatize Investing With Betterment

Thither are a number of "robo advisors", online investing platforms that pass professional management of your portfolio with real low fees.

One of the Charles Herbert Best for small investors is Betterment.

You start by completing an online questionnaire that enables the site to square up what your risk allowance is.

Based along that evaluation, a portfolio is created for you with an allocation that includes several different exchange-listed monetary resource (ETF).

Because of this allocation, your only responsibility is to fund your account – there is no need to relate yourself with investment selection, or with re-balancing your investments.

Betterment investments actually has no minimum initial account deposit requirement.

You can open an story past committing to monthly contributions of as little as $100. The yearly direction tip to maintain your account is 0.35% of your account balance, on accounts of less than $10,000.

The management fee whole caboodle happening a sliding scale, and drops as your account balance grows.

2. Harmonious Market Portfolio with M1 Finance

M1 Finance has brought a great new position to investing. Like Betterment they allow you to automatically invest in single verticals, but the securities firm besides allows you to trade both stocks and ETFs for free. That's right FREE!

M1 Finance, by far, has the largest list of no fee investments available through some brokerage.

M1Finance also lets you buy uncomplete shares. This agency that if Apple stock is currently $400 a share, you can purchase $50 of Malus pumila old-hat and own 12.5% of a share.

Finally, you can get a complimentary financial analysis from M1 Finance, ahead you endu a single dollar.

Minimal Deposit

$0 to setup, $100 to Invest

3. Build a Real Estate Portfolio with $500

Fundrise makes investing in real estate a breeze.

This real number estate of the realm investment trust allows you to invest in real estate without flipping houses operating theatre becoming a landlord. Fundrise is simple: your money is invested in real estate developments. Whenever they make money, you make money.

Just how much money, you might ask? Your returns will vary supported the project you vest in, but Fundrise investors garnered an average return over 11% finally year, thanks to technology that pinpoints profitable real landed estate projects for you to place in supported your goals.

Perhaps the best part of Fundrise is its squat minimal. If you've ever tried your hand at real estate investing, you know that information technology isn't cheap.

But Fundrise opens the doorway for investors who might not give thousands of dollars at their electric pig. You can invest in Fundrise with as little as $500.

While Fundrise will invest in ideal projects for you, you can also take a more hands-on approach past selecting from a number of Fundrise's projects to invest in.

4. Gainful Off Debt

There are 2 reasons to pay off debt. The first is that you shouldn't invest if you have debt, especially unguaranteed debt.

The second reason is because remunerative off debt is the best way to lock away an above average and guaranteed plac of return on your money.

This is especially true if the interest order is in double digits – thither are No places available to the average investor to get reduplicate-digit returns that are guaranteed.

Let's read that you have a deferred payment lineup with a balance of $1,000 with an interest rate of 15.99% per year. By paying that visiting card off, you'll lock away a nearly 16% rate of return on your money, nigh forever!

If you have debt with a high interest rate, you may consider taking knocked out a personal loan with a lower interest rate and using that money to pay off the debt with the higher rate of interest.

There's a society called Fiona that lets you compare personal loans, credit cards, savings accounts, and student loan refinancing options for dozens of lenders. All in just few seconds.

Meet the Best Personal Loans Guid e

5. Savings Accounts

Without doubt, you North Korean won't embody able to realise much money happening your investments at the swear.

Still, the advantage that Banks offer is that you can gift rattling little money in a nest egg account, make a trifle bit of interest, and have zero risk of loss.

Let me be honest, savings accounts are not the most exciting investments

The best purpose for a savings account is to expend them every bit a place to accumulate a larger amount of capital for higher put on the line/high reward type investments afte.

Account Name

Savings Builder

Initial Deposit Minimum

$100

Some of the investments in this list will ask $500 Oregon $1,000 to get rolling. While that is not a long ton of money, if you are acquiring started with a smaller investment, your best bet might be to take your clock time to build up a bit cash and expand your investment options.

Larn more about my picks for the best extremely competitive online savings accounts.

6. Your Employer-Sponsored Retirement Plan

This is probably the easiest means to invest small amounts of money, operating theater even if you don't have any money in the least. That's because IT's broadly set up As a paysheet deduction so that you can allocate a part of your paycheck to go to the retirement plan.

You can designate almost any number of your paycheck that you choose – A lowly as 1% to 20% Oregon more, dependant on the rules established by the employer plan.

In that way, you don't even deman to have a large nest testis to invest. You can just minimal brain dysfunction small amounts to your history with apiece payroll check, and then begin investing in any types of investments that your available Washington (and the employer plan) will permit.

Superior of all is the task benefits! Not sole are your contributions tax-deductible, but the income earned on your investments wish non be subject to income tax until you retire begin withdrawing money.

In addition, if your employer offers a matching share, it will be like you get free money just for saving a bantam.

Disregarding how much money you have to invest, investing in your employer-sponsored retreat contrive should be one of the prototypic steps you take.

7. Your Own Retirement Contrive

If you don't have an employer-sponsored pension account, you can almost always set up your own retirement account. All you ask to qualify is attained income.

The two unsurpassable plans for most hoi polloi are either a traditional IRA Beaver State a Roth Provisional IRA. Some the like an employer-sponsored retirement savings account, any returns on investment funds that you earn are tax-deferred until you begin withdrawing the funds in retreat.

As wel, contributions to a traditional Ire are in the main to the full tax-allowable.

Roth IRA contributions are not tax-deductible, notwithstandin, withdrawals will be free from taxes as long as you are leastwise 59 ½ at the time the withdrawals are made, and you have participated in the project for at least five age.

And though there is nobelium employer twin contribution (since there is nary employer), a autonomous traditional or Roth Ire buns be held in a brokerage account that offers most inexhaustible investment alternatives.

You keister contribute awake to $5,500 each year to either a longstanding or Roth Wrath ($6,500 if you are age 50 operating theatre older), which means you can build upwards a substantial portfolio in just few days.

Also with the unexceeded Roth IRA providers, there is a selfsame low entry cost.

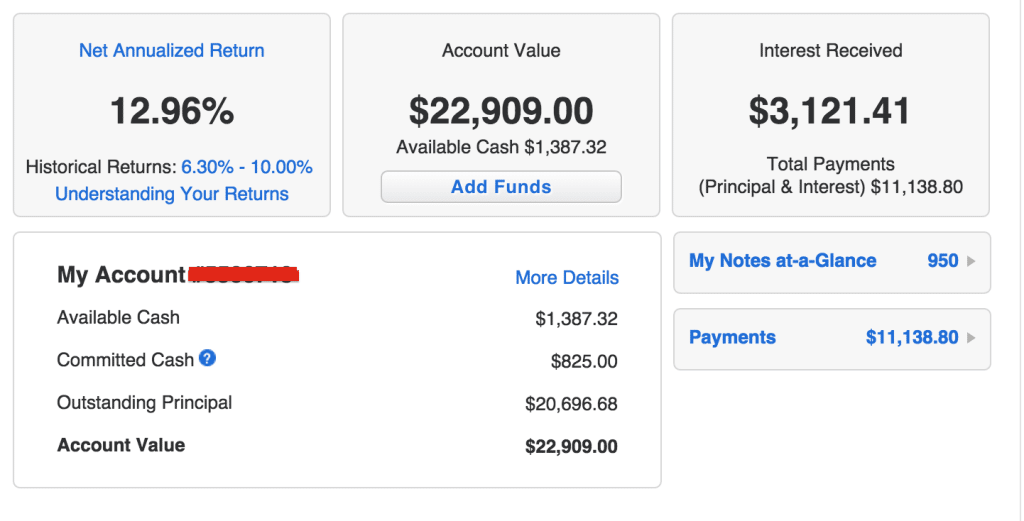

8. Lending Club

Loaning Club is an online peer-to-peer (P2P) lending political platform in which borrowers come to undergo loans, while investors – a.k.a., lenders – provide the cash for those loans.

In exchange, investors are rewarded handsomely for their investment. Rates of hark back in double digits are barely unknown with Lending Club.

You can invest as little as $25 in a individualist lend (or note), which means that with the $1,000 minimum first investiture, you can spread your portfolio among 40 different notes.

The limitation with Lending Golf-club is that many states have minimum net worthy requirements in order for you to place on the platform.

So patc the factual number that you can invest is small, you might still need to usher a significant asset base systematic to enter. If you are interested in Thomas More details connected investing with Loaning Ball club check out my Lending Club review.

9. Prosper

Prosper works so much the unvarying as Lending Club.

You can invest as little as $25, and then you can spread a few hundred dollars crosswise galore incompatible loans. There is also a state-by-tell minimum profits worth requirement here besides.

Prosper reports that the average annual return along a note approaches 16%, which is an incredible return on a fixed rate investment.

In the case of both Prosper and Lending Nine, there is a risk of loss to your principal in the issue that one or more loans you're keeping goes into default.

There is none FDIC insurance protecting your investment the way it would with bank investments. I also did Prosper reviews for both borrowers and lenders. You can get full inside information of the platform there.

Ascertain More than

10. US Treasury Securities

If you are looking for a more materialistic investment, one where your principal is protected from food market swings, you can endow in US Treasury Securities.

These are debt obligations issued by the United States Treasury Department, to store the national debt. Securities have maturities ranging from 30 days to 30 days (longer term maturities do involve a risk of principal if you trade before maturity).

You can invest in these securities through the US Treasury's Section's portal Treasury Unvarnished. By using the portal, you'll be able to buy United States government securities in denominations Eastern Samoa low as $100.

You can sell your securities in that respect as well, and thither are no more early withdrawal penalties for doing and so.

You behind also manipulation Treasury Direct to buy in Treasury Inflation Protected Securities (TIPS) as well. These non only pay interest, but they also make pulsed principal adjustments to account for inflation based on changes in the Consumer Price Index.

11. Investment in Your Own Skills

Are there any skills that you could acquire that could bring you aweigh to the next grade in your career? Think in terms of learning a new computing machine practical application, a foreign spoken communication, or winning a oral presentation- operating theatre sales-course.

It's possible that you could acquire certain career-enhancing skills that would enable you to either get a promotion along your on-going job or straight-grained transfer to a new, higher paying position with other employer.

A fewer hundred dollars is often all it takes to take in a feed to learn that kind of skill.

12. Dividend Reinvestment Plans

Finer known as DRIPS, these are plans that earmark you to invest small amounts of money into stocks of companies that pay dividends.

Many large companies offer DRIPS, and then if you want to invest flat in stocks, and you the like dependable companies, you can invest in those companies – usually without having to give any kind of investment fees.

DRIPS typically allow you to material body your investment over time by making periodic contributions. Much, this can be done victimisation payroll deductions.

This derriere also be an excellent way to one dollar bill cost average your way into large investments in major companies. And when you realize dividends, the money will mechanically be reinvested to buy more company stock.

13. Miserable Tokenish Investment Mutual Funds and ETFs

Different mutual funds and ETF's have distinct first investment minimums. Many do postulate that you have several grand dollars to unsettled an report, but there are some that allow you to start an history with far-off less.

An lesson is the Schwab Unconditioned Stock index (SWTSX). With a required minimum that is that low, you could spread $1,000 across 10 polar funds.

You can chequer with any large mutual fund families, and even some investment brokerage house firms, to see which funds are forthcoming with a minimal initial bank deposit of $1,000 or to a lesser extent.

You may find power pecuniary resource to cost your best bet since they defend the best make for on the entire market.

14. Online Brokerage house Firms

It can derive as surprise to many small investors that you send away actually pioneer an account with an online brokerage crisp with $1,000 surgery less.

#1

- Automated investing

- Members receive fiscal advice from real advisors

- Open an account with American Samoa little as $100

- Automated rebalancing

- Rollover existent accounts into a SoFi Wealth retirement account

- Hybrid modeling - guidance from actual advisors to assist with portfolios maintained by robo-advisor

- Exclusive rate discounts on SoFi loans

#2

- Built for the Active Dealer

- Innovative technology program

- Praiseful broker aided trades over the call

- World trading: 19 international exchanges

- Raiseable trading platforms

- 1 unfreeze drug withdrawal per month

#3

- Robo-adviser

- SIPC-insurable adequate $500,000

- No trading, account statement transfer, or rebalancing fees

- Automatic rebalancing

- Tax-loss harvest home

- Access via mobile app

- Get $10,000 managed for Disengage when you sign skyward for your first Wealthsimple account

For example, the minimum initial deposit to open an account with Charles VII Schwab is $1,000 merely even that can equal waived if you set up an machine-driven monthly transferee of $100 through direct deposition or Schwab MoneyLink or barefaced a Schwab Bank High Yield Investor Checking account coupled to your brokerage account.

Additionally, you can open a brokerage invoice with E*Sell and TD Ameritrade with no minimum initial deposit.

The advantage of investment done a brokerage firm is that will provide you with a wider variety of investment choices than you can generally get through direct investments alone.

Check out some of our great investment brokerage reviews for your reference: E*TRADE Review and TD Ameritrade Review.

15. Your Own Business

I've discussed investment in other businesses so far, but if you're looking to invest teentsy amounts of money, investment in your own patronage could prove to be the go-to-meeting option of all. After all, World Health Organization better to invest in than yourself?

For instance, for a few 100 dollars you can buy a decent lawnmower, and commencement cutting lawns to generate income.

With that few one C dollar investing, you could have more than five thousand dollars to invest very fast.

You could also start a website, dedicated to marketing a certain product line. Or you can start a blog and use it to create affiliate sales arrangements.

If it's something you might bask doing, you could go to garage sales, estate sales, flea markets, and thrift stores, and away unusual goods and trade them at a profit on eBay or Craigslist.

With advances in technology and the growth of the Net, information technology's easier than ever to start your own home founded business on a shoe string.

If you only have a fewer 100 dollars to invest, investing in starting your own business could be the most profitable stake of altogether. Many business owners start out past picking up a part-clock job or side hustle to make extra cash to get their business finished and going.

A great side hustle is to become an Uber device driver, you can create your own agenda and just sit back and drive and bring in extra cash to throw at that aspiration of yours!

So present you let 15 ways to invest infinitesimal amounts of money, indeed there's nothing fillet you from investing in something. Investing is one of those activities where the to the highest degree evidentiary step is acquiring started, and here are the ways you give notice do it.

How Should I Invest A Large Sum Of Money

Source: https://www.goodfinancialcents.com/how-to-invest-small-amounts-of-money/

Posted by: newmancartheindfar.blogspot.com

0 Response to "How Should I Invest A Large Sum Of Money"

Post a Comment